REGISTER LOGIN GST shall be levied and charged on the taxable supply of. ClearTax GST with its powerful billing vendor data mismatch reconciliation mechanism validation engines and return filing process serves as a single platform for all GST compliance.

Plastic Aadhar Card Kaise Banaye Pvc Aadhar Card Pvc Aadhar Card Onl Aadhar Card Cards Pvc

Visit the GST portal - httpswwwgstgovin.

. Enter the name of the business. Click on the Register Now link which can be found under the Taxpayers tab. We acknowledge First Nations Peoples as the Traditional Owners Custodians and Lore Keepers of the worlds oldest living culture and pay respects to their Elders past present and emerging.

You can create 100 GST complaint bills or bulk import sales and purchase data from your accounting software such as Tally in excel format. COMPLAINT. AGENCY Browse other government agencies and NGOs websites from the list.

Imported goods are subject to GST andor duty payment. Enter the PAN of the business. More 112 10052019 Compliance Audit Framework.

Travellers with purchases that have exceeded their personal duty free concession or GST relief can use CustomsSG. After 30th September 2017 drawback will be admissible only at lower rate determined on the basis of the custom duties paid on the goods imported for supplying goods for export. Mutual Recognition Arrangement MRA between JKDM and Japan Custom 1st March 2015 16 February 2015 Network Maintenance for AEO System 03 October 2014 Electrical Maintenance for AEO system 15 October 2012 CGC Front End standard Edition Version 180 14 October 2011 CGC Front End standard Edition.

Electronic Cash Ledger to be maintained on GST Portal gstgovin. If an exporter has stock of GST paid inputs as well as inputs from pre-GST period and if inputs from both lots are used in export goods what shall be Drawback on such exports. Fill the below-mentioned details.

A customs permit is required to account for the import and tax payment of the goods. 172017 under the Central Board of Excise and Customs Department of Revenue Ministry of Finance Government of India is the Jurisdictional Central Tax Authority for administering the GST Acts Central Excise Act 1944 and Finance Act 1994 in the State of Karnataka. All goods imported into Singapore are regulated under the Customs Act the Goods and Services Tax GST Act and the Regulation of Imports and Exports Act.

The CustomsSG web application is a convenient way for travellers to declare and pay duty andor Goods and Services Tax GST on their overseas purchases anytime anywhere before the travellers arrive in Singapore. We recognise the First Peoples of this nation and their ongoing connection to culture and country. Hence the importer can claim input credit of IGST and the Customs Duty will be added in the cost of imported goods-Purchase Ac_____Dr.

GST Guide On Declaration And Adjustment After 1st September 2018. Further the Customs duty is also applicable in the case of Import of Goods but the input credit of Custom duty is not allowed. Check With Expert GST shall be levied and charged on the taxable supply of goods and services.

More 111 17052019 GST Guide On Tax Invoice Debit Note Credit Note And Retention Payment After 1st September 2018. IGST Input Credit Ac _____Dr. EVENT CALENDAR Check out whats happening.

To calculate GST value based on the salespurchase value. Dutiable goods which incur both GST and duty are. The electronic acquisition system better known as ePerolehan will facilitate government procurement activities and improve the quality of services provided.

The Bangalore Central Tax Zone which has come into existence wef. Under the I am a drop-down menu select Taxpayer. More 113 02052019 Borang SST-ADM.

Select the respective state and district. More 114 30042019. AMOUNT RM SUBTOTAL RM.

CGC Front End standard Edition Version 190for GST.

Firsemodi Better Norms Better Checklist Result In Better Authenticity Tax Credits Checklist Debit

The Complete Guide On Collecting Gst Hst For Self Employed Canadians 2022 Turbotax Canada Tips

Do I Really Have To Get A Hst Gst Number Personal Tax Advisors

Ukraine Immigration Measures Financial Assistance Canada Ca

Customs Code Classification And Revision Ncm Novatrade

A Quick Guide To Customs Regulations In Asia Dhl Logistics Of Things

Pin By شمامه ايبو On Iraqi Flag Iraqi Flag Islamic Art Calligraphy Picture Tattoos

Cheap Com Domain Registration Domain Name Sanity Blog

How To Get A Gst Number In Canada Gst Registration

Government Support Programs Canadian Camping And Rv Council

The Complete Guide On Collecting Gst Hst For Self Employed Canadians 2022 Turbotax Canada Tips

Nato Science For Peace And Security Camp Energy Efficiency Project

Notifying Canada Revenue Agency Cra Of A Change Of Address 2022 Turbotax Canada Tips

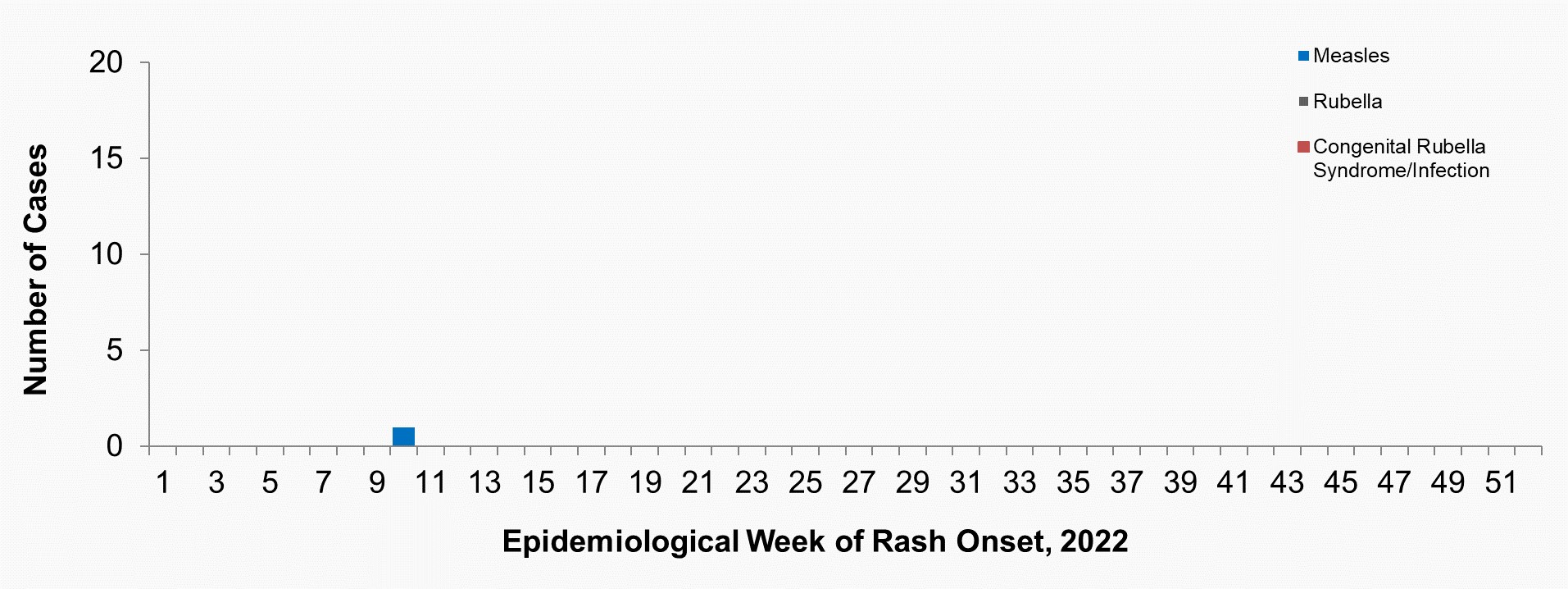

Measles Rubella Weekly Monitoring Report Week 18 May 1 To May 7 2022 Canada Ca

The Complete Guide On Collecting Gst Hst For Self Employed Canadians 2022 Turbotax Canada Tips

Do I Really Have To Get A Hst Gst Number Personal Tax Advisors

Tax Dispute Resolution Kpmg Global

Do I Really Have To Get A Hst Gst Number Personal Tax Advisors